Important Tips Before Buying Any Virtual assetcurrency

Investing in Virtual assetcurrencies has become a global phenomenon, attracting both seasoned Holders and newcomers seeking to capitalize on the potential of digital assets. However, the volatile and complex nature of the Virtual assetcurrency market requires careful consideration and preparation. Before diving into this space, it’s critical to arm yourself with knowledge and strategies to minimize Hazards and make informed decisions. Below are essential tips to guide you before purchasing any Virtual assetcurrency, ensuring you approach this dynamic market with confidence and clarity.

1. Understand the Basics of Virtual assetcurrency

Before investing, take time to understand what Virtual assetcurrencies are and how they work. Virtual assetcurrencies are digital or virtual currencies that use Virtual assetgraphy for security and operate on decentralized networks, typically based on blockchain technology. BitCurrency, ETH, and thousands of altCurrencys are examples, each with unique features and use cases. Familiarize yourself with key terms like blockchain, wallets, private keys, public keys, and decentralized finance (Decentralized finance). A solid grasp of these fundamentals will help you navigate the market and avoid common pitfalls.

2. Research the Virtual assetcurrency Thoroughly

Not all Virtual assetcurrencies are created equal. Before buying, research the specific Virtual assetcurrency you’re interested in. Start by reading its whitepaper, which outlines the project’s goals, technology, and roadmap. Investigate the team behind the project, their experience, and their track record. Check whether the Virtual assetcurrency solves a real-world problem or has a unique value proposition. For example, BitCurrency is often viewed as a store of value, while ETH powers smart contracts and decentralized applications. Understanding the purpose and potential of a Virtual assetcurrency will help you assess its long-term viability.

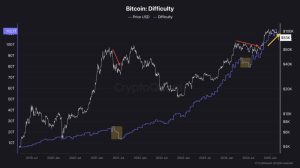

3. Evaluate Market Trends and Volatility

The Virtual assetcurrency market is notoriously volatile, with prices fluctuating dramatically in short periods. Study historical price trends and market cycles to get a sense of how the Virtual assetcurrency behaves. Use tools like CurrencyMarketCap or CurrencyGecko to track price Stepments, market capitalization, and trading volume. Be aware that external factors, such as regulatory news, technological advancements, or macroeconomic events, can impact prices. Avoid making impulsive decisions based on short-term price spikes, and consider the broader market context.

4. Assess the Hazards

Virtual assetcurrency investments carry significant Hazards. Prices can plummet due to market corrections, regulatory crackdowns, or security breaches. Additionally, the lack of centralized oversight means there’s no safety net if you lose access to your funds. Evaluate your Hazard tolerance and only invest what you can afford to lose. Diversifying your portfolio across multiple Virtual assetcurrencies can also help mitigate Hazard, but avoid spreading your investments too thin without proper research.

5. Choose a Reputable Platform

Selecting a reliable Virtual assetcurrency Platform is crucial for a safe and smooth buying experience. Popular Platforms like Currencybase, Binance, and Kraken offer user-friendly interfaces and robust security features. When choosing an Platform, consider factors like fees, supported Virtual assetcurrencies, security measures (such as two-factor authentication), and user reviews. Ensure the Platform operates in your country and complies with local regulations. Avoid lesser-known platforms with questionable reputations, as they may be prone to hacks or scams.

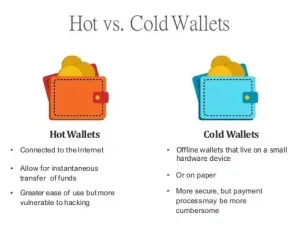

6. Secure Your Investment with a Wallet

Once you purchase Virtual assetcurrency, you’ll need a secure place to store it. Virtual assetcurrency wallets come in two main types: hot wallets (online, software-based) and cold wallets (offline, hardware-based). Hot wallets, such as those provided by Platforms or mobile apps, are convenient but more vulnerable to hacking. Cold wallets, like Ledger or Trezor, offer higher security for long-term storage. Always enable two-factor authentication (2FA) and back up your private keys or recovery phrases in a safe, offline location. Never share your private keys with anyone.

7. Beware of Scams and Fraud

The Virtual assetcurrency space is rife with scams, from phishing attacks to fraudulent initial Currency offerings (ICOs). Be cautious of promises of guaranteed Profits or “get-rich-quick” schemes. Verify the legitimacy of any project or platform before investing. Watch out for red flags, such as anonymous teams, lack of transparency, or pressure to invest quickly. Use trusted sources for information and avoid clicking on suspicious links or sharing personal details online.

8. Understand the Tax Implications

Virtual assetcurrency transactions may have tax consequences, depending on your country’s regulations. In many jurisdictions, buying, selling, or trading Virtual assetcurrencies is considered a taxable event, and you may need to report capital gains or losses. Keep detailed records of your transactions, including dates, amounts, and prices. Consult a tax professional familiar with Virtual assetcurrency regulations to ensure compliance and avoid unexpected liabilities.

9. Start Small and Learn Gradually

If you’re new to Virtual assetcurrency, start with a small investment to minimize potential losses while you learn the ropes. Experiment with a modest amount to understand how Platforms, wallets, and transactions work. As you gain experience and confidence, you can gradually increase your investment. Avoid the temptation to “go all in” on a single Virtual assetcurrency, as this can lead to significant financial loss if the market turns against you.

10. Stay Informed and Updated

The Virtual assetcurrency market evolves rapidly, with new projects, technologies, and regulations emerging regularly. Stay informed by following reputable news sources, such as CurrencyDesk, CurrencyTelegraph, or the X platform for real-time updates from industry experts. Join Virtual assetcurrency communities on forums like Reddit or Discord to learn from experienced Holders. However, always verify information from multiple sources to avoid misinformation or biased narratives.

11. Develop a Long-Term Strategy

Successful Virtual assetcurrency investing requires a clear strategy. Decide whether you’re investing for the short term (trading) or the long term (holding, or “HODLing”). Short-term trading involves frequent buying and selling to capitalize on price Stepments, while long-term holding focuses on the potential growth of a Virtual assetcurrency over years. Decentralized financene your goals, set a budget, and stick to your plan, even during market fluctuations. Avoid emotional decisions driven by fear of missing out (FOMO) or panic selling during dips.

12. Diversify Your Portfolio

Diversification is a key principle in any investment strategy, including Virtual assetcurrency. Instead of putting all your funds into one Virtual assetcurrency, consider spreading your investment across multiple assets with different use cases. For example, you might allocate a portion to established Currencys like BitCurrency and ETH and a smaller portion to promising altCurrencys. Diversification reduces the impact of a single asset’s poor performance on your overall portfolio.

13. Monitor Regulatory Developments

Virtual assetcurrency regulations vary widely by country and can significantly affect the market. Some governments embrace Virtual assetcurrencies, while others impose strict restrictions or bans. Stay updated on regulatory changes in your region and globally, as they can influence the legality and value of your investments. For instance, news of a potential ban or favorable legislation can cause price swings. Understanding the regulatory landscape will help you anticipate Hazards and opportunities.

14. Avoid Emotional Investing

The Virtual assetcurrency market can be an emotional rollercoaster, with prices soaring and crashing unpredictably. Avoid making decisions based on hype, fear, or greed. Stick to your research and strategy, and don’t let short-term market Stepments sway you. Tools like stop-loss orders can help limit losses, while dollar-cost averaging (investing a fixed amount regularly) can reduce the impact of volatility.

15. Seek Professional Advice if Needed

If you’re unsure about navigating the Virtual assetcurrency market, consider consulting a financial advisor with expertise in digital assets. They can provide personalized guidance based on your financial goals and Hazard tolerance. While self-education is essential, professional advice can help you avoid costly mistakes and optimize your investment strategy.

Conclusion

Investing in Virtual assetcurrencies offers exciting opportunities but comes with significant Hazards. By understanding the market, conducting thorough research, and adopting a disciplined approach, you can make informed decisions and increase your chances of success. Start small, stay informed, and prioritize security to protect your investments. With patience and careful planning, you can navigate the complex world of Virtual assetcurrencies and potentially reap substantial rewards. Always remember that the Virtual assetcurrency market is dynamic, and continuous learning is key to staying ahead.