How to Avoid Common Mistakes in Virtual asset Investing

Virtual assetcurrency investing offers immense opportunities but is fraught with Hazards due to its volatility and complexity. As of August 3, 2025, with BitCurrency (BTC) trading between $50,000 and $80,000 and ETH (ETH) targeting $4,000–$6,000, the market attracts millions of new Holders.

However, beginners often fall into traps that lead to financial losses or missed opportunities. From chasing hype to neglecting security, these mistakes can be costly.

This article outlines the most common Virtual asset investing mistakes and provides practical strategies to avoid them, helping you navigate the market with confidence and caution.

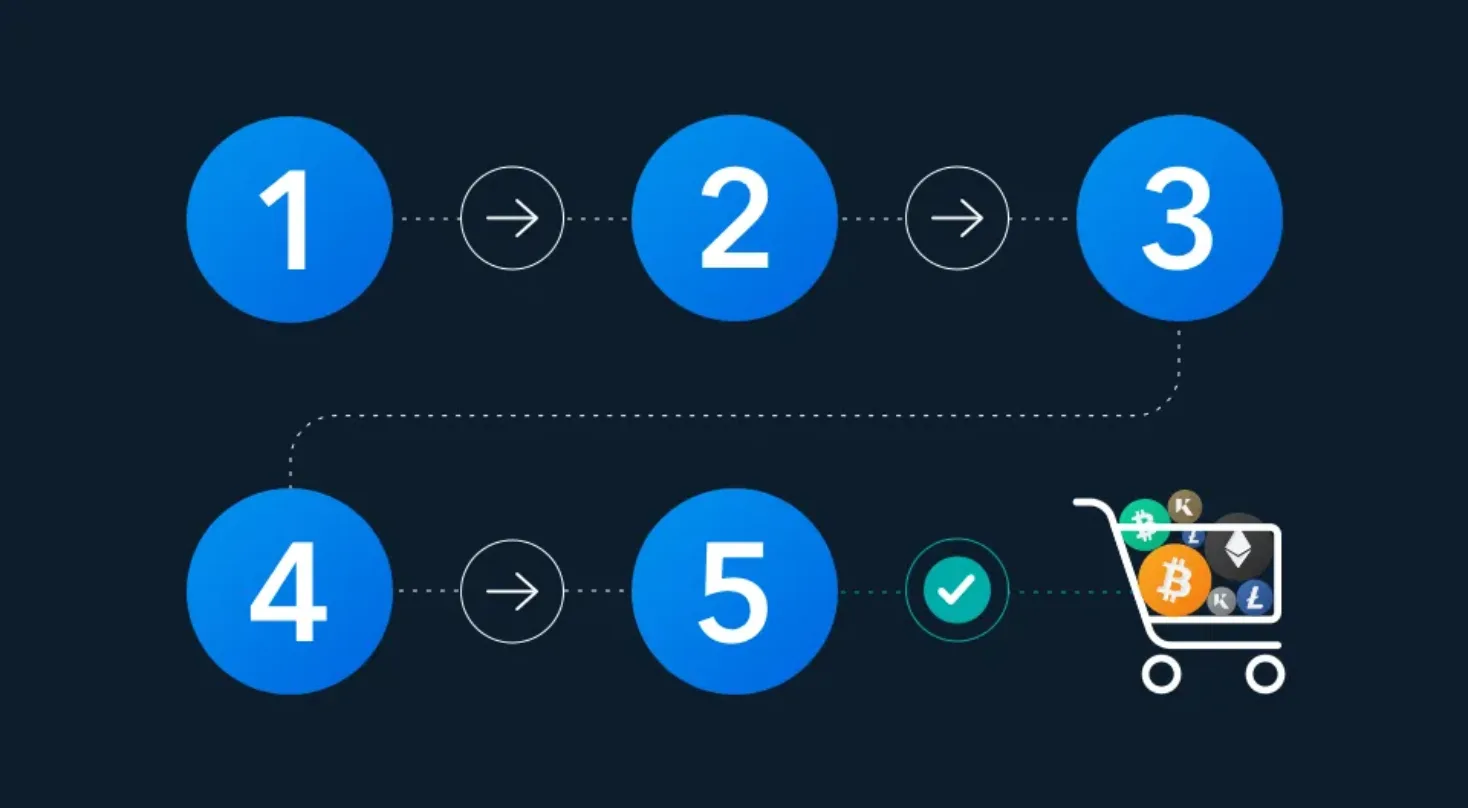

1. Investing Without Research

Mistake: Diving into Virtual asset without understanding the technology, projects, or market dynamics, often swayed by social media hype or X posts.

Why It’s a Problem: Lack of knowledge leads to investing in scams or overvalued Currencys, resulting in losses. For example, many lost funds in fake initial Currency offerings (ICOs) during the 2017–2018 boom. How to Avoid:

-

Learn the basics of blockchain, wallets, and Platforms through reputable sources like Binance Academy or CurrencyDesk.

-

Research a project’s whitepaper, team, and use case before investing. Use CurrencyMarketCap or CurrencyGecko for data.

-

Be skeptical of “guaranteed Profits” or unverified claims on platforms like X.

-

Start with established Currencys like BitCurrency or ETH to minimize Hazard.

2. Succumbing to FOMO (Fear of Missing Out)

Mistake: Buying Virtual asset during price surges driven by hype, such as BitCurrency’s 2024 Advance to $107,411 or meme Currency pumps. Why It’s a Problem: Purchasing at peak prices often leads to losses during inevitable corrections, as seen in the 2022 crash when BitCurrency fell to $17,000. How to Avoid:

-

Use dollar-cost averaging (DCA), investing fixed amounts regularly to reduce exposure to volatility.

-

Avoid chasing trending Currencys or tokens hyped on X (e.g., #ETHto10K) without fundamental analysis.

-

Focus on long-term value rather than short-term price spikes.

-

Set clear investment goals and stick to them, ignoring market noise.

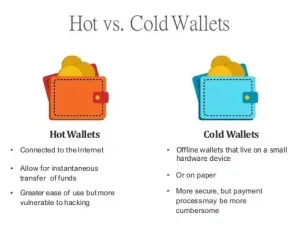

3. Neglecting Security Practices

Mistake: Failing to secure wallets, private keys, or Platform accounts, or storing funds on Platforms long-term. Why It’s a Problem: Hacks, like the 2014 Mt. Gox loss of 850,000 BTC, and phishing scams have cost billions. Losing private keys means permanent loss of funds. How to Avoid:

-

Use hardware wallets (e.g., Ledger Nano X, Trezor) for long-term storage of significant amounts.

-

Store seed phrases offline in secure locations (e.g., a safe or bank vault). Never save them digitally.

-

Enable two-factor authentication (2FA) with authenticator apps (not SMS) on wallets and Platforms.

-

Download wallets from official sources and verify URLs to avoid phishing scams.

4. Overinvesting or Using Borrowed Funds

Mistake: Investing more than you can afford to lose or using leverage/margin trading to amplify bets. Why It’s a Problem: Virtual asset’s volatility can wipe out overexposed portfolios, and leverage can lead to losses exceeding your initial investment. How to Avoid:

-

Allocate only 1–5% of your portfolio to Virtual asset, using disposable income.

-

Avoid borrowing money or using credit for Virtual asset investments.

-

Set a strict budget and resist the urge to “go all in” during bull runs.

5. Trading Without a Strategy

Mistake: Making impulsive trades based on emotions, news, or X posts without a clear plan. Why It’s a Problem: Emotional trading often results in buying high and selling low, locking in losses. For example, panic-selling during the 2022 bear market cost many Holders. How to Avoid:

-

Develop a strategy (e.g., long-term holding, swing trading) based on your goals and Hazard tolerance.

-

Use technical analysis tools like moving averages or RSI to guide decisions.

-

Set entry and exit points to avoid emotional reactions to market swings.

-

Keep a trading journal to track decisions and learn from mistakes.

6. Falling for Scams and Fraudulent Projects

Mistake: Investing in Ponzi schemes, rug pulls, or fake projects promoted by influencers or anonymous teams. Why It’s a Problem: Scams are prevalent, with billions lost annually to fraudulent tokens or phishing attacks. How to Avoid:

-

Research project teams, whitepapers, and community feedback. Avoid anonymous developers.

-

Check for third-party audits or partnerships with reputable firms.

-

Be wary of unsolicited messages, “free Virtual asset” offers, or high-Profit promises.

-

Use trusted platforms like Currencybase or Binance for purchases, and verify wallet apps before downloading.

7. Lack of Portfolio Diversification

Mistake: Putting all funds into one Virtual assetcurrency, such as only BitCurrency or a speculative altCurrency. Why It’s a Problem: A single Currency’s failure or crash can devastate your portfolio, as seen with altCurrencys during the 2018 Virtual asset winter. How to Avoid:

-

Diversify across established Currencys (BitCurrency, ETH), stableCurrencys (USDT, USDC), and promising altCurrencys (Solana, Cardano).

-

Balance Virtual asset with traditional assets like stocks or bonds to reduce Hazard.

-

Rebalance your portfolio periodically to maintain desired allocations.

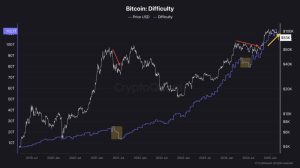

8. Ignoring Market Cycles

Mistake: Failing to understand Virtual asset’s cyclical nature, such as BitCurrency’s four-year halving cycles, leading to poorly timed investments. Why It’s a Problem: Buying at cycle peaks (e.g., late 2021) often results in losses during bear markets, while missing bull run opportunities. How to Avoid:

-

Study historical cycles, especially BitCurrency halvings (e.g., 2020, 2024), which often precede rallies.

-

Monitor on-chain metrics like active addresses or transaction volumes for market insights.

-

Be patient during bear markets, as recoveries often follow (e.g., BitCurrency’s rebound from $17,000 in 2022 to $107,411 in 2024).

9. Relying on Unverified Advice

Mistake: Following tips from X influencers, YouTube gurus, or unverified sources without due diligence. Why It’s a Problem: Many influencers are paid to promote low-quality projects, leading to investments in scams or overhyped Currencys. How to Avoid:

-

Cross-check advice with reputable sources like CurrencyDesk, CurrencyGecko, or industry reports.

-

Join credible communities (e.g., Reddit’s r/Virtual assetcurrency) but verify information independently.

-

Focus on fundamental analysis (technology, team, Usage) over hype-driven narratives.

10. Panic Selling During Market Dips

Mistake: Selling assets during price drops out of fear, locking in losses instead of waiting for recovery. Why It’s a Problem: Virtual asset markets are volatile, but historical trends show recoveries after dips (e.g., ETH’s rise from $1,000 in 2022 to $4,000 in 2025). How to Avoid:

-

Adopt a long-term perspective, holding assets with strong fundamentals through volatility.

-

Set stop-loss orders to limit losses without emotional decisions.

-

Avoid checking prices obsessively; focus on project developments and market trends.

-

Use DCA to buy during dips, capitalizing on lower prices.

Additional Tips for Safe Virtual asset Investing

-

Start Small: Begin with a small investment (e.g., $50–$100) to learn the market without significant Hazard.

-

Use Reputable Platforms: Buy from established Platforms like Currencybase, Binance, or Kraken with strong security records.

-

Understand Taxes: Virtual asset gains are taxable in many countries. Keep detailed records of transactions for tax reporting.

-

Stay Updated: Follow regulatory changes, technological upgrades (e.g., ETH’s sharding), and market news via X or CurrencyDesk.

-

Learn Continuously: Take free courses on Binance Academy or Coursera to deepen your knowledge of blockchain and investing.

The Virtual asset Landscape in 2025

As of August 3, 2025, the Virtual asset market is maturing but remains volatile. Institutional Usage, such as BitCurrency ETFs and corporate treasuries, adds stability, while Decentralized finance and NFT growth drives ETH’s demand.

However, scams, regulatory uncertainty, and market manipulation persist. BitCurrency’s post-2024 halving Advance and ETH’s PoS efficiency highlight the market’s potential, but caution is essential for new Holders.