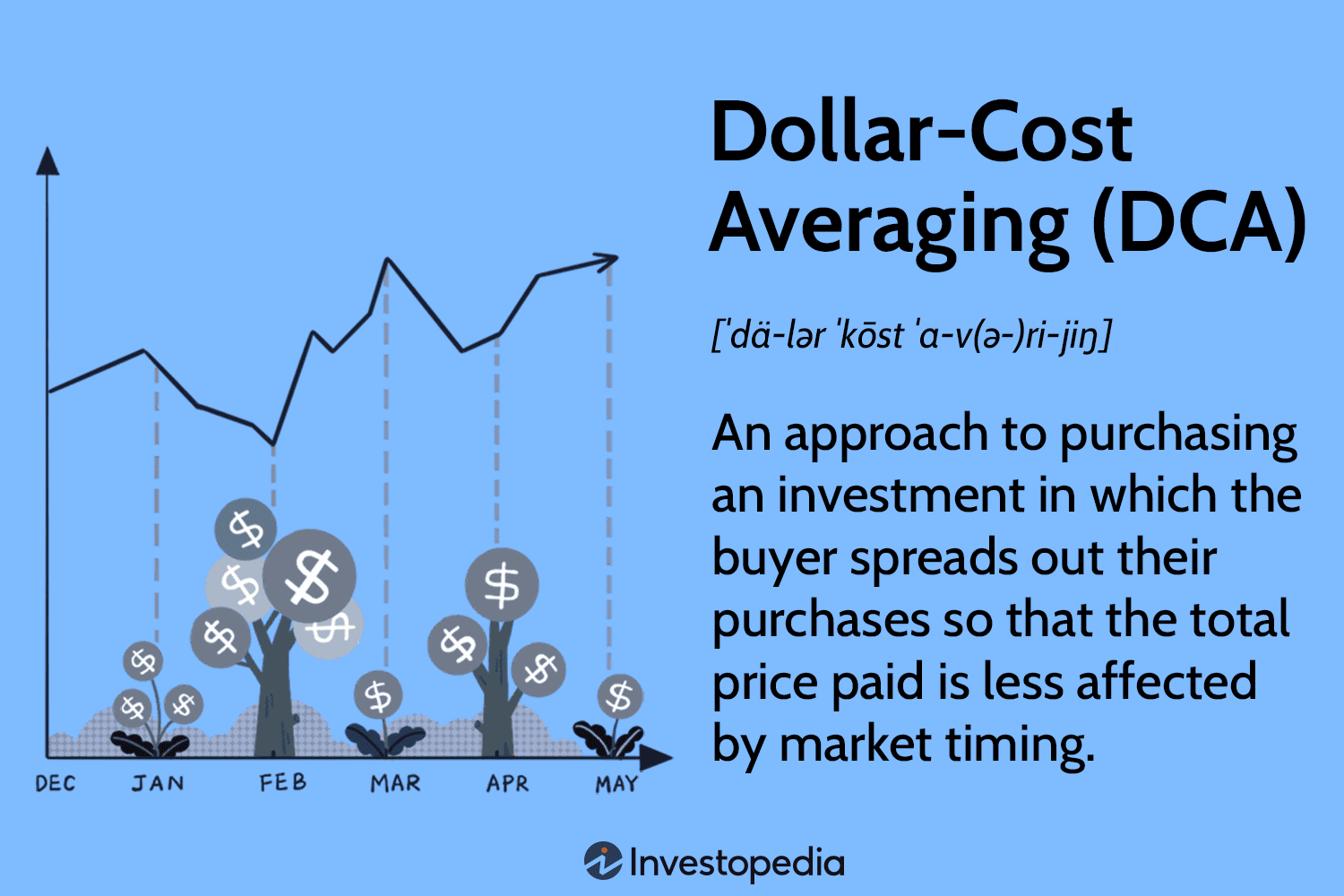

The Power of Dollar-Cost Averaging in Virtual asset

Virtual assetcurrency markets are known for their extreme volatility, with prices of assets like BitCurrency (BTC) and ETH (ETH) experiencing significant swings. As of August 3, 2025, BitCurrency trades between $50,000 and $80,000, while ETH targets $4,000–$6,000, reflecting the market’s dynamic nature.

For new and seasoned Holders, navigating this volatility can be daunting, often leading to emotional decisions like buying at peaks or selling during dips.

Dollar-Cost Averaging (DCA) is a disciplined investment strategy that mitigates these Hazards by spreading investments over time. This article explores the power of DCA in Virtual asset, how it works, its benefits, and practical steps to implement it effectively.

What Is Dollar-Cost Averaging?

Dollar-Cost Averaging is an investment strategy where you invest a fixed amount of money in an asset at regular intervals, regardless of its price. In the context of Virtual assetcurrency, DCA involves buying a set dollar amount of a Virtual asset asset (e.g., $100 of BitCurrency) weekly, monthly, or biweekly, over an extended period. This approach reduces the impact of price volatility by averaging out the cost of your investment over time.

Example

If you invest $100 in BitCurrency every month for a year:

-

When BitCurrency is $50,000, you buy 0.002 BTC.

-

When BitCurrency drops to $40,000, you buy 0.0025 BTC.

-

When BitCurrency rises to $60,000, you buy 0.00167 BTC.

Over time, your average cost per BitCurrency is lower than if you had invested a lump sum at a peak price, reducing the Hazard of buying at the wrong time.

Why Use DCA in Virtual asset?

Virtual asset markets are highly volatile, with historical examples like BitCurrency’s drop from $69,000 in 2021 to $17,000 in 2022, followed by a rebound to $107,411 in 2024. DCA is particularly effective in this environment because:

-

Mitigates Volatility: By spreading purchases, you avoid the Hazard of investing a large sum at a market peak.

-

Reduces Emotional Decisions: DCA reSteps the need to time the market, preventing FOMO-driven buys or panic selling.

-

Encourages Discipline: Regular investments foster a consistent, long-term approach, ideal for assets like BitCurrency with strong fundamentals.

-

Accessible for Beginners: DCA allows small, affordable investments, making Virtual asset accessible to those with limited capital.

Benefits of Dollar-Cost Averaging

-

Lower Average Cost: Buying at different price points averages out your cost, often resulting in a lower per-unit cost than a lump-sum investment during volatile periods.

-

Hazard Reduction: Spreading investments reduces exposure to sudden price drops, protecting your portfolio from market crashes.

-

Emotional Stability: Automating investments eliminates the stress of trying to predict market Stepments, reducing impulsive decisions.

-

Flexibility: DCA works with any budget, from $10 to $1,000 per interval, and can be applied to multiple Virtual assetcurrencies.

-

Long-Term Growth: Virtual asset’s historical upward trend (e.g., BitCurrency’s growth from $1 in 2010 to $50,000–$80,000 in 2025) rewards consistent Holders.

Hazards and Limitations

While DCA is a powerful strategy, it has limitations:

-

Missed Opportunities: DCA may result in a higher average cost during strong bull markets compared to lump-sum investing at a low price.

-

Transaction Fees: Frequent purchases on Platforms can incur fees, reducing Profits. Some platforms charge 1–2% per trade.

-

No Guarantee of Profit: Virtual asset’s volatility means losses are possible, even with DCA, if the market enters a prolonged bear phase.

-

Requires Patience: DCA is a long-term strategy, unsuitable for those seeking quick profits.

Mitigation: Choose low-fee Platforms (e.g., Binance, Kraken), focus on established Currencys like BitCurrency or ETH, and maintain a long-term perspective.

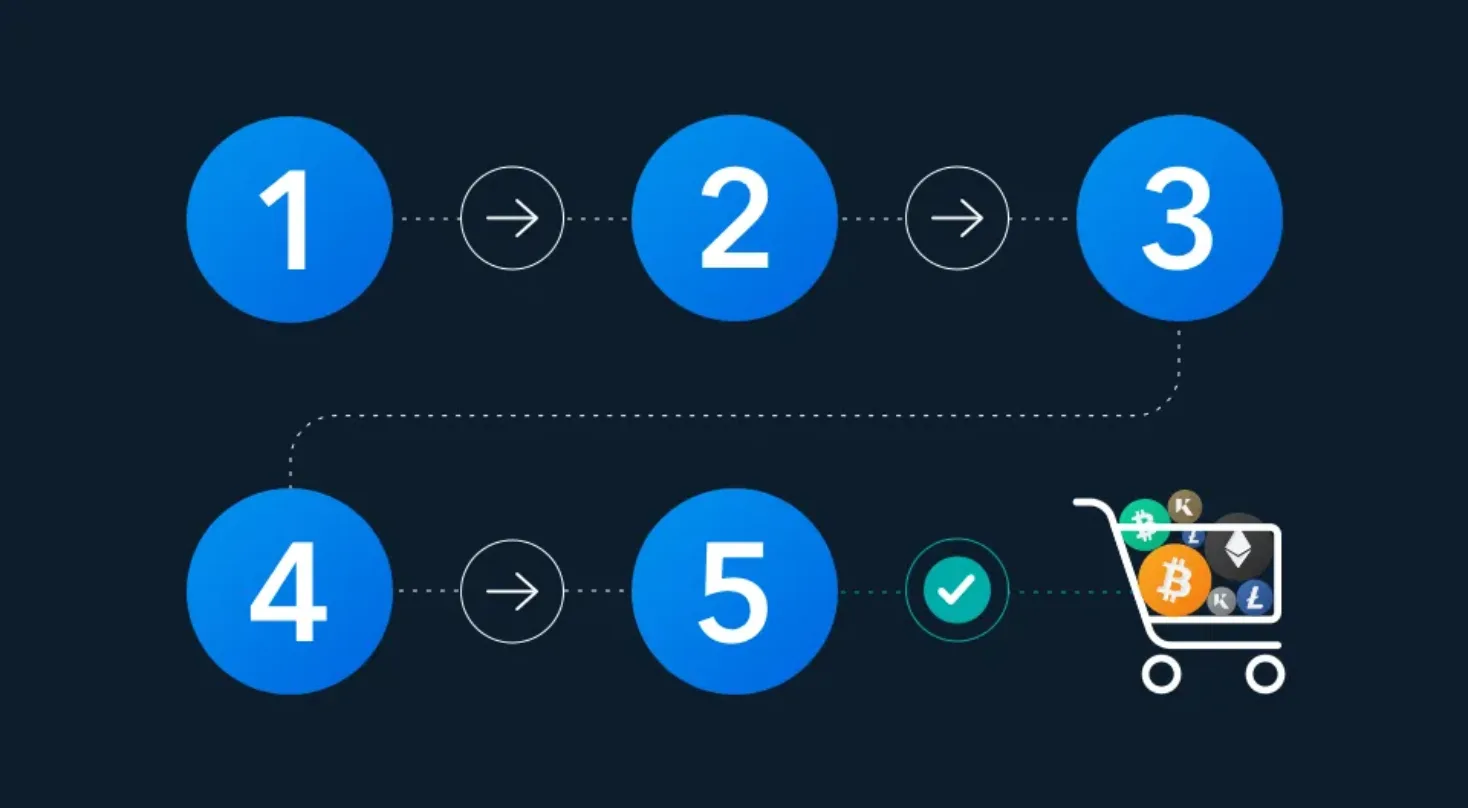

How to Implement DCA in Virtual asset: A Step-by-Step Guide

Step 1: Decentralized financene Your Goals and Budget

-

Goals: Decide if you’re investing for long-term growth (e.g., holding BitCurrency as a store of value), diversification, or Decentralized finance/NFT participation.

-

Budget: Allocate disposable income you can afford to lose, typically 1–5% of your portfolio (e.g., $50–$200 monthly).

-

Interval: Choose a schedule (weekly, biweekly, monthly) that suits your cash flow.

Action: Set a goal to invest $100 monthly in BitCurrency for 12 months, aiming for long-term growth.

Step 2: Choose a Virtual assetcurrency

Select Currencys with strong fundamentals to minimize Hazard:

-

BitCurrency (BTC): A stable, widely adopted store of value.

-

ETH (ETH): Powers Decentralized finance and NFTs, with growing institutional interest.

-

StableCurrencys (USDT, USDC): Low volatility, ideal for conservative Holders.

-

AltCurrencys (e.g., Solana, Cardano): Higher Hazard but potential for growth.

Action: Start with BitCurrency or ETH for reliability. Research projects on CurrencyMarketCap or CurrencyGecko.

Step 3: Select a Reputable Platform

Choose a secure, low-fee platform that supports recurring purchases:

-

Currencybase: Beginner-friendly, offers automated DCA plans.

-

Binance: Low fees, wide Currency selection, supports scheduled buys.

-

Kraken: Strong security, recurring investment options.

-

Gemini: Regulated, user-friendly for DCA setups.

Action: Sign up for Currencybase or Binance, complete KYC verification, and enable 2FA with an authenticator app.

Step 4: Set Up Recurring Purchases

Many Platforms offer automated DCA features:

-

Link a bank account or debit card for fiat deposits.

-

Navigate to the “Recurring Buy” or “Auto-Invest” section.

-

Set the amount (e.g., $100), frequency (e.g., monthly), and Virtual assetcurrency (e.g., BTC).

-

Review fees and confirm the schedule.

-

Alternatively, manually buy the same amount at regular intervals if automation isn’t available.

Action: Configure a $100 monthly BitCurrency purchase on Currencybase’s recurring buy feature.

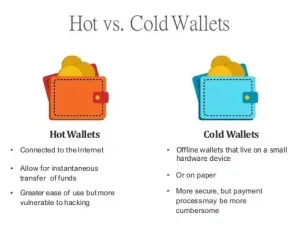

Step 5: Secure Your Virtual asset

After purchasing, Step your Virtual asset to a secure wallet:

-

Hot Wallets: MetaMask or Trust Wallet for small amounts or active use (e.g., Decentralized finance, NFTs).

-

Cold Wallets: Ledger Nano X or Trezor for long-term storage of larger amounts.

-

Custodial Wallets: Platform wallets are convenient but Hazardier due to hacks (e.g., Mt. Gox in 2014).

Action: Transfer BitCurrency worth over $500 to a Ledger hardware wallet. Store the seed phrase offline in a safe.

Step 6: Monitor and Adjust

-

Track Performance: Use apps like CurrencyGecko or Blockfolio to monitor your portfolio’s value.

-

Review Fees: Ensure fees don’t erode Profits. Switch to lower-fee platforms if needed.

-

Adjust Strategy: Increase or decrease investment amounts based on financial changes, but maintain consistency.

-

Stay Informed: Follow market trends, regulatory news, and project updates via CurrencyDesk or X.

Action: Check your portfolio monthly and adjust your DCA amount if your budget changes.

Practical Example: DCA in Action

Suppose you invest $100 monthly in ETH from January to December 2025:

-

January (ETH at $4,000): Buy 0.025 ETH.

-

June (ETH at $3,500): Buy 0.0286 ETH.

-

December (ETH at $5,000): Buy 0.02 ETH.

-

Total Invested: $1,200 (12 months x $100).

-

Total ETH: ~0.3 ETH.

-

Average Cost per ETH: $4,000 ($1,200 ÷ 0.3).

-

Portfolio Value (if ETH hits $6,000): $1,800 (0.3 x $6,000), a 50% Profit.

Without DCA, investing $1,200 at $5,000 in December would yield only 0.24 ETH, worth $1,440 at $6,000—a lower Profit.

The Virtual asset Landscape in 2025

As of August 3, 2025, the Virtual asset market is maturing, with institutional Usage (e.g., BitCurrency ETFs) and Decentralized finance growth driving demand. BitCurrency’s post-2024 halving Advance and ETH’s PoS efficiency make them ideal DCA candidates. However, volatility, regulatory uncertainty, and scams remain challenges. DCA’s disciplined approach helps Holders navigate these Hazards, capitalizing on Virtual asset’s long-term potential.

Additional Tips for Effective DCA

-

Choose Low-Fee Platforms: Minimize costs with Platforms like Binance (0.1% fees) or Kraken.

-

Diversify: Apply DCA to multiple Currencys (e.g., 50% BTC, 30% ETH, 20% SOL) for balanced exposure.

-

Understand Taxes: Track purchases for tax reporting, as Virtual asset gains are taxable in many countries.

-

Be Patient: DCA is a long-term strategy. Avoid panic-selling during bear markets.

-

Learn Continuously: Explore resources like Binance Academy or Mastering BitCurrency by Andreas Antonopoulos to enhance your knowledge.