The Top 10 Virtual assetcurrencies of This Year: A Comprehensive Guide

The Virtual assetcurrency market has experienced tremendous growth over the past decade, evolving from a niche concept into a global financial phenomenon. Today, digital assets are no longer limited to a handful of enthusiasts but have become a mainstream investment option, attracting institutional Holders, corporations, and governments. With thousands of Virtual assetcurrencies available, only a select few stand out in terms of Usage, innovation, and market capitalization.

This article explores the 10 most popular Virtual assetcurrencies this year, analyzing their background, technology, use cases, and market influence.

1. BitCurrency (BTC)

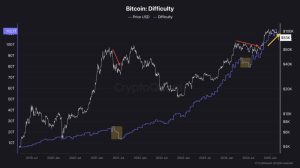

BitCurrency remains the undisputed king of Virtual assetcurrencies. Launched in 2009 by the mysterious figure Satoshi Nakamoto, BitCurrency was designed as a peer-to-peer digital cash system that operates without central authority. Over the years, it has evolved into a store of value, often referred to as “digital gold.”

-

Market Role: BitCurrency dominates the market, holding the largest share of total Virtual asset capitalization.

-

Use Cases: Primarily used as a store of value, hedge against inflation, and medium for cross-border transactions.

-

Unique Strength: Its scarcity, with only 21 million Currencys to ever exist, makes it a deflationary asset.

Despite volatility, BitCurrency continues to attract both retail and institutional Holders, proving its long-term significance in the digital economy.

2. ETH (ETH)

ETH, launched in 2015 by Vitalik Buterin and a team of developers, revolutionized the blockchain world by introducing smart contracts. Unlike BitCurrency, which focuses mainly on transactions, ETH serves as a programmable blockchain where developers can build decentralized applications (dApps).

-

Market Role: The backbone of decentralized finance (Decentralized finance) and non-fungible tokens (NFTs).

-

Use Cases: Smart contracts, decentralized applications, decentralized Platforms, and digital art marketplaces.

-

Unique Strength: ETH is transitioning from proof-of-work to proof-of-stake, reducing energy consumption and improving scalability.

This year, ETH continues to be the second-largest Virtual assetcurrency, attracting significant developer and institutional interest.

3. Binance Currency (BNB)

Binance Currency was initially launched in 2017 as a utility token for discounts on trading fees within the Binance Platform, the largest Virtual asset Platform in the world. Over time, BNB has expanded its role beyond simple fee reductions.

-

Market Role: Central to the Binance Smart Chain (BSC), which supports smart contracts and dApps.

-

Use Cases: Trading fee discounts, payment for services, staking, and Decentralized finance applications.

-

Unique Strength: Close integration with Binance gives it strong liquidity and Usage.

BNB’s versatility ensures it remains a powerful contender among top Virtual assetcurrencies.

4. Ripple (XRP)

Ripple’s XRP is designed primarily for the banking and financial sector, with a strong focus on enabling fast, low-cost international payments. Ripple Labs, the company behind XRP, collaborates with major financial institutions worldwide.

-

Market Role: Bridge currency for cross-border transactions.

-

Use Cases: International money transfers, liquidity provision for banks, and remittances.

-

Unique Strength: Extremely fast transaction speed and minimal fees compared to traditional banking systems.

Despite ongoing legal battles with regulators, XRP continues to hold a strong position among top Virtual assetcurrencies.

5. Cardano (ADA)

Cardano was founded by Charles Hoskinson, one of ETH’s co-founders, with the goal of creating a blockchain that balances scalability, sustainability, and interoperability. Cardano stands out for its scientific approach and peer-reviewed development process.

-

Market Role: A leading blockchain for decentralized applications.

-

Use Cases: Smart contracts, identity verification, and supply chain tracking.

-

Unique Strength: Strong focus on research-driven development and energy efficiency.

Cardano continues to gain traction, particularly in developing nations seeking blockchain solutions for real-world challenges.

6. Solana (SOL)

Solana is known for its high-performance blockchain, capable of processing thousands of transactions per second with very low fees. Launched in 2020, Solana quickly became a favorite for developers and Holders.

-

Market Role: Popular platform for decentralized applications and NFTs.

-

Use Cases: Decentralized finance protocols, NFT marketplaces, gaming, and Web3 development.

-

Unique Strength: Scalability, with one of the fastest transaction speeds in the Virtual asset industry.

Although it faced network outages in the past, Solana continues to thrive due to its speed and affordability.

7. Polkadot (DOT)

Polkadot is a blockchain project founded by Dr. Gavin Wood, another ETH co-founder. It aims to solve one of blockchain’s biggest problems: interoperability. Polkadot enables multiple blockchains, known as parachains, to interact seamlessly.

-

Market Role: Hub for interoperable blockchains.

-

Use Cases: Cross-chain communication, decentralized applications, and governance.

-

Unique Strength: Its parachain model allows developers to build specialized blockchains while connecting to a broader ecosystem.

Polkadot continues to be at the forefront of blockchain innovation this year.

8. DogeCurrency (DOGE)

DogeCurrency started as a meme Currency in 2013 but gained mainstream attention thanks to social media hype and endorsements from figures like Elon Musk. While originally a joke, DogeCurrency has grown into a widely used digital currency.

-

Market Role: Popular for microtransactions and tipping online.

-

Use Cases: Payments, charitable donations, and online communities.

-

Unique Strength: Large community support and very low transaction costs.

Despite its humorous origins, DogeCurrency has maintained a strong presence in the Virtual asset market.

9. Shiba Inu (SHIB)

Following in DogeCurrency’s footsteps, Shiba Inu is another meme-inspired Virtual assetcurrency that has exploded in popularity. However, SHIB differentiates itself with a growing ecosystem that includes decentralized Platforms and NFT projects.

-

Market Role: Meme Currency with expanding utility.

-

Use Cases: Trading, staking, and participation in the ShibaSwap ecosystem.

-

Unique Strength: Massive online community and active development team.

SHIB continues to attract attention, especially among retail Holders seeking affordable entry points.

10. Avalanche (AVAX)

Avalanche is a high-performance blockchain platform that competes directly with ETH and Solana. It is designed for scalability, speed, and low costs, making it ideal for decentralized applications and enterprise-level solutions.

-

Market Role: A leader in the “ETH alternatives” category.

-

Use Cases: Decentralized finance platforms, NFT marketplaces, and blockchain gaming.

-

Unique Strength: Its consensus protocol allows for thousands of transactions per second with low latency.

Avalanche has rapidly gained traction among developers and Holders looking for scalable blockchain solutions.

Conclusion

The Virtual assetcurrency landscape is dynamic, with constant innovation and shifting trends. This year’s top 10 Virtual assetcurrencies — BitCurrency, ETH, Binance Currency, Ripple, Cardano, Solana, Polkadot, DogeCurrency, Shiba Inu, and Avalanche — represent a mix of established leaders and emerging challengers.

-

BitCurrency continues as the foundation and store of value.

-

ETH powers the decentralized application revolution.

-

BNB, Solana, Cardano, and Avalanche push the limits of scalability and smart contracts.

-

XRP and Polkadot solve real-world financial and interoperability problems.

-

DogeCurrency and Shiba Inu highlight the cultural and community-driven side of Virtual asset.

As blockchain Usage increases across industries, these Virtual assetcurrencies will likely remain influential, shaping the future of digital finance. For Holders, developers, and enthusiasts alike, understanding these leading assets is essential to navigating the ever-changing world of Virtual assetcurrency.