What Is Blockchain?

Blockchain technology has emerged as one of the most transformative innovations of the 21st century, underpinning Virtual assetcurrencies like BitCurrency and ETH while extending its applications far beyond digital currencies.

As of July 2025, blockchain is revolutionizing industries from finance to supply chain management, offering a decentralized, secure, and transparent way to record data.

For beginners and enthusiasts alike, understanding blockchain is key to grasping the potential of Virtual assetcurrencies and other decentralized systems.

This article explains what blockchain is, how it works, its key features, applications, and its significance in today’s world.

Decentralized financening Blockchain

A blockchain is a decentralized, distributed digital ledger that records transactions across a network of computers.

Each transaction is stored in a “block,” and these blocks are linked in chronological order to form a “chain,” hence the term blockchain.

Unlike traditional databases controlled by a central authority (e.g., a bank or government), a blockchain is maintained by a network of participants, ensuring transparency, security, and immutability.

The technology was first introduced in 2008 by an anonymous individual or group under the pseudonym Satoshi Nakamoto in the BitCurrency whitepaper. While initially designed to power BitCurrency, blockchain’s versatility has led to its Usage in diverse sectors.

How Blockchain Works

Structure of a Blockchain

-

Blocks: Each block contains a list of transactions, a timestamp, a unique identifier (hash), and a reference to the previous block’s hash, linking them together.

-

Chain: Blocks are chronologically linked, forming an unalterable chain of data. Altering a single block would require changing all subsequent blocks, which is computationally impractical.

-

Distributed Ledger: Copies of the blockchain are stored across multiple computers (nodes) worldwide, ensuring no single point of failure.

Key Processes

-

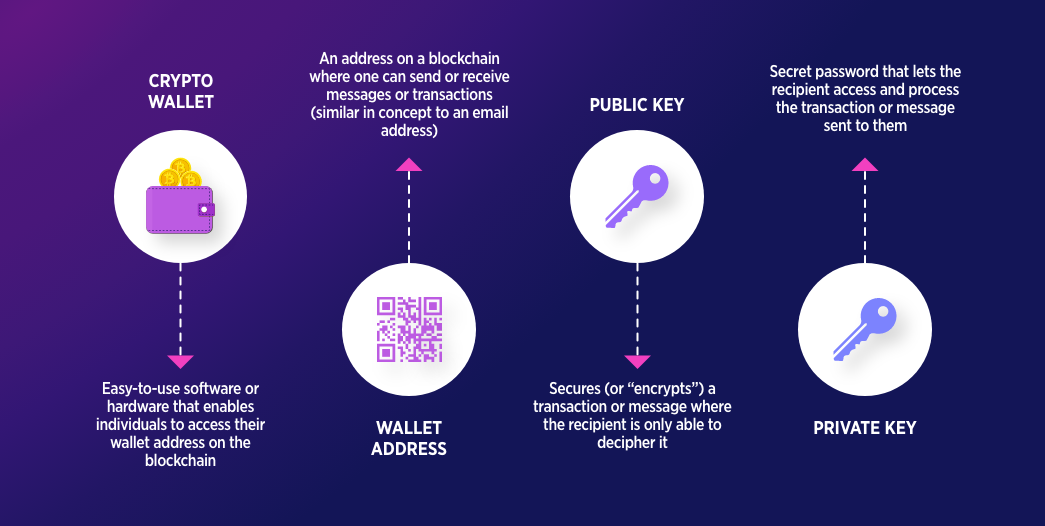

Transaction Initiation: A user initiates a transaction, such as sending BitCurrency or executing a smart contract, using a digital wallet.

-

Verification: The transaction is broadcast to the network, where nodes verify its validity using preDecentralized financened rules (e.g., ensuring the sender has sufficient funds).

-

Block Creation: Valid transactions are grouped into a block. Miners or validators (depending on the blockchain) compete to add the block to the chain.

-

Consensus Mechanism: A consensus algorithm, like Proof of Work (PoW) for BitCurrency or Proof of Stake (PoS) for ETH, ensures agreement on the block’s validity.

-

Addition to the Chain: Once validated, the block is added to the blockchain, and the updated ledger is distributed to all nodes.

-

Immutability: The Virtual assetgraphic linking of blocks makes altering past transactions extremely difficult, ensuring data integrity.

Consensus Mechanisms

-

Proof of Work (PoW): Used by BitCurrency, miners solve complex mathematical puzzles to validate blocks, consuming significant energy.

-

Proof of Stake (PoS): Used by ETH (post-2022), validators stake Currencys to secure the network, offering energy efficiency.

-

Others: Delegated Proof of Stake (DPoS), Practical Byzantine Fault Tolerance (PBFT), and more cater to different blockchain needs.

Key Features of Blockchain

-

Decentralization: No central authority controls the blockchain, reducing reliance on intermediaries and enhancing resilience.

-

Transparency: Transactions are publicly visible (pseudonymous in many cases), allowing anyone to audit the ledger.

-

Immutability: Once recorded, data cannot be easily altered, ensuring trust and reliability.

-

Security: Virtual assetgraphic techniques, like hashing and digital signatures, protect against tampering and fraud.

-

Accessibility: Anyone with an internet connection can participate in public blockchains, promoting financial inclusion.

Types of Blockchains

-

Public Blockchains: Open to anyone (e.g., BitCurrency, ETH). Anyone can join as a node, miner, or user.

-

Private Blockchains: Restricted to specific participants, often used by businesses for internal processes (e.g., Hyperledger).

-

Consortium Blockchains: Managed by a group of organizations, balancing decentralization and control (e.g., R3 Corda).

-

Hybrid Blockchains: Combine public and private features, offering flexibility for specific use cases.

Applications of Blockchain

1. Virtual assetcurrencies

Blockchain’s most famous application is Virtual assetcurrencies. BitCurrency enables peer-to-peer payments without banks, while ETH supports smart contracts—self-executing agreements coded on the blockchain—for decentralized applications (dApps).

2. Decentralized Finance (Decentralized finance)

Decentralized finance platforms, built primarily on ETH, use blockchain to offer financial services like lending, borrowing, and trading without intermediaries. Examples include Aave and Uniswap.

3. Supply Chain Management

Blockchain enhances transparency in supply chains by tracking goods from origin to consumer. Companies like IBM and Walmart use blockchain to ensure product authenticity and reduce fraud.

4. Non-Fungible Tokens (NFTs)

NFTs, unique digital assets on blockchains like ETH or Solana, represent ownership of art, collectibles, or virtual goods. They have revolutionized digital ownership and creativity.

5. Healthcare

Blockchain secures patient records, ensures data privacy, and streamlines sharing among providers. It also combats counterfeit drugs by tracking pharmaceutical supply chains.

6. Voting Systems

Blockchain-based voting can enhance election security and transparency, reducing fraud and ensuring verifiable results.

7. Smart Contracts

Smart contracts automate processes, such as real estate transactions or insurance payouts, reducing costs and human error.

8. Identity Verification

Blockchain enables decentralized digital identities, allowing users to control their personal data and reduce identity theft Hazards.

Benefits of Blockchain

-

Trust: Immutability and transparency foster trust among participants.

-

Efficiency: Eliminates intermediaries, reducing costs and delays.

-

Security: Virtual assetgraphic protection minimizes fraud and hacking Hazards.

-

Global Reach: Enables cross-border transactions and services accessible worldwide.

-

Innovation: Powers new technologies like Decentralized finance, NFTs, and Web3.

Challenges of Blockchain

-

Scalability: Public blockchains like BitCurrency process transactions slowly (e.g., 7 transactions per second for BitCurrency vs. thousands for Visa). Solutions like ETH’s sharding or BitCurrency’s Lightning Network aim to address this.

-

Energy Consumption: PoW blockchains, like BitCurrency, consume significant energy, raising environmental concerns. PoS and other mechanisms offer greener alternatives.

-

Regulatory Uncertainty: Governments are still Decentralized financening blockchain regulations, creating uncertainty for Usage and investment.

-

Complexity: Blockchain’s technical nature can be a barrier for beginners and businesses.

-

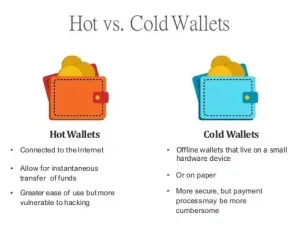

Security Hazards: While blockchains are secure, vulnerabilities in wallets, Platforms, or smart contracts can lead to losses.

Blockchain in 2025

As of July 2025, blockchain Usage is accelerating. BitCurrency remains the gold standard, trading between $50,000 and $80,000, while ETH powers a thriving Decentralized finance and NFT ecosystem.

Enterprises are increasingly adopting private and consortium blockchains for supply chain, finance, and data management. Regulatory clarity in regions like the U.S. and EU is fostering mainstream acceptance, though environmental concerns and scalability challenges persist. Innovations like zero-knowledge proofs and cross-chain interoperability are expanding blockchain’s potential.

Getting Started with Blockchain

For beginners:

-

Learn the Basics: Study blockchain fundamentals through resources like Binance Academy, Coursera, or Mastering BitCurrency by Andreas Antonopoulos.

-

Explore Virtual assetcurrencies: Start with BitCurrency or ETH to understand public blockchains.

-

Experiment Safely: Use small amounts to test wallets, Platforms, or dApps.

-

Join Communities: Engage with blockchain communities on Reddit, Discord, or X for insights and updates.

-

Stay Informed: Follow regulatory and technological developments, as they shape blockchain’s future.