Virtual asset Market Rebounds After Fed Signals Rate Pause

The Virtual assetcurrency market experienced a significant rebound in late July 2025, following the U.S. Federal Reserve’s decision to pause interest rate changes at its July 29–30 meeting, maintaining the federal funds rate at 4.25%–4.50%.

As of August 3, 2025, BitCurrency (BTC) is trading between $50,000 and $80,000, while ETH (ETH) targets $4,000–$6,000, reflecting renewed Holder optimism.

This article explores the reasons behind the market’s recovery, the impact of the Fed’s rate pause, and strategies for Holders navigating this dynamic landscape.

The Federal Reserve’s Rate Pause

At its July 29–30, 2025, meeting, the Federal Open Market Committee (FOMC) opted to hold interest rates steady, marking the fifth consecutive meeting without a change.

This decision followed a 25-basis-point cut in December 2024, bringing rates to their current range. Fed Chair Jerome Powell emphasized a cautious approach, citing persistent inflation (2.5% PCE in 2025) and economic uncertainties, including potential tariffs under President Donald Trump’s policies.

The Fed’s updated projections suggest only two rate cuts in 2025, down from earlier expectations of three to four, signaling a prolonged pause to monitor inflation and growth.

Why Rates Matter for Virtual asset

Interest rates influence liquidity and Holder Hazard appetite:

-

High Rates: Increase borrowing costs and bond yields, drawing capital to safer assets and reducing demand for volatile Virtual assetcurrencies.

-

Low Rates or Pauses: Encourage investment in Hazardier assets like Virtual asset by lowering the appeal of fixed-income securities and easing liquidity constraints.

The rate pause signaled stable financial conditions, boosting confidence in Hazard assets like BitCurrency, ETH, and altCurrencys. Posts on X noted BitCurrency’s resilience, with prices stabilizing near $118,000 before dipping to $115,700 and rebounding, reflecting market sensitivity to Fed signals.

Why the Virtual asset Market Rebounded

The Virtual asset market’s Advance in late July 2025 was driven by several factors tied to the Fed’s decision:

-

Increased Liquidity: The pause, coupled with the Fed’s slower balance-sheet runoff (capped at $5 billion/month for Treasuries), signaled looser financial conditions, historically favorable for Virtual asset. BitCurrency surged 4% to $85,786 post-announcement, with ETH and Solana gaining 7% and 8%, respectively.

-

Hazard-On Sentiment: Stable rates reduced pressure on borrowing costs, encouraging Holders to allocate capital to Virtual assetcurrencies. Virtual asset stocks like Currencybase (+7.8%) and Marathon Digital (+12.6%) also spiked, reflecting broader market enthusiasm.

-

Institutional Interest: BitCurrency ETFs saw $483 million in weekly inflows, reversing prior outflows, while anticipation for Solana ETFs grew. Institutional capital, seeking higher Profits in a low-yield environment, bolstered market confidence.

-

Global Easing Trends: The People’s Bank of China’s liquidity injections and other central banks’ dovish policies complemented the Fed’s stance, supporting Hazard assets globally.

-

Market Resilience: Despite mixed signals (e.g., $675 million in liquidations post-December 2024 cut), the Virtual asset market’s total capitalization rose 2% to $2.91 trillion, driven by BitCurrency’s stability and altCurrency gains.

Impact on Key Virtual assetcurrencies

-

BitCurrency (BTC): Jumped 3–4% to $85,786–$87,470, with analysts eyeing $112,000 if rate cuts materialize sooner. Its role as a store of value strengthened as the U.S. dollar weakened slightly post-pause.

-

ETH (ETH): Climbed 7% to ~$2,038–$3,887, fueled by Decentralized finance and NFT demand. Lower rates enhance ETH’s appeal for yield-seeking Holders.

-

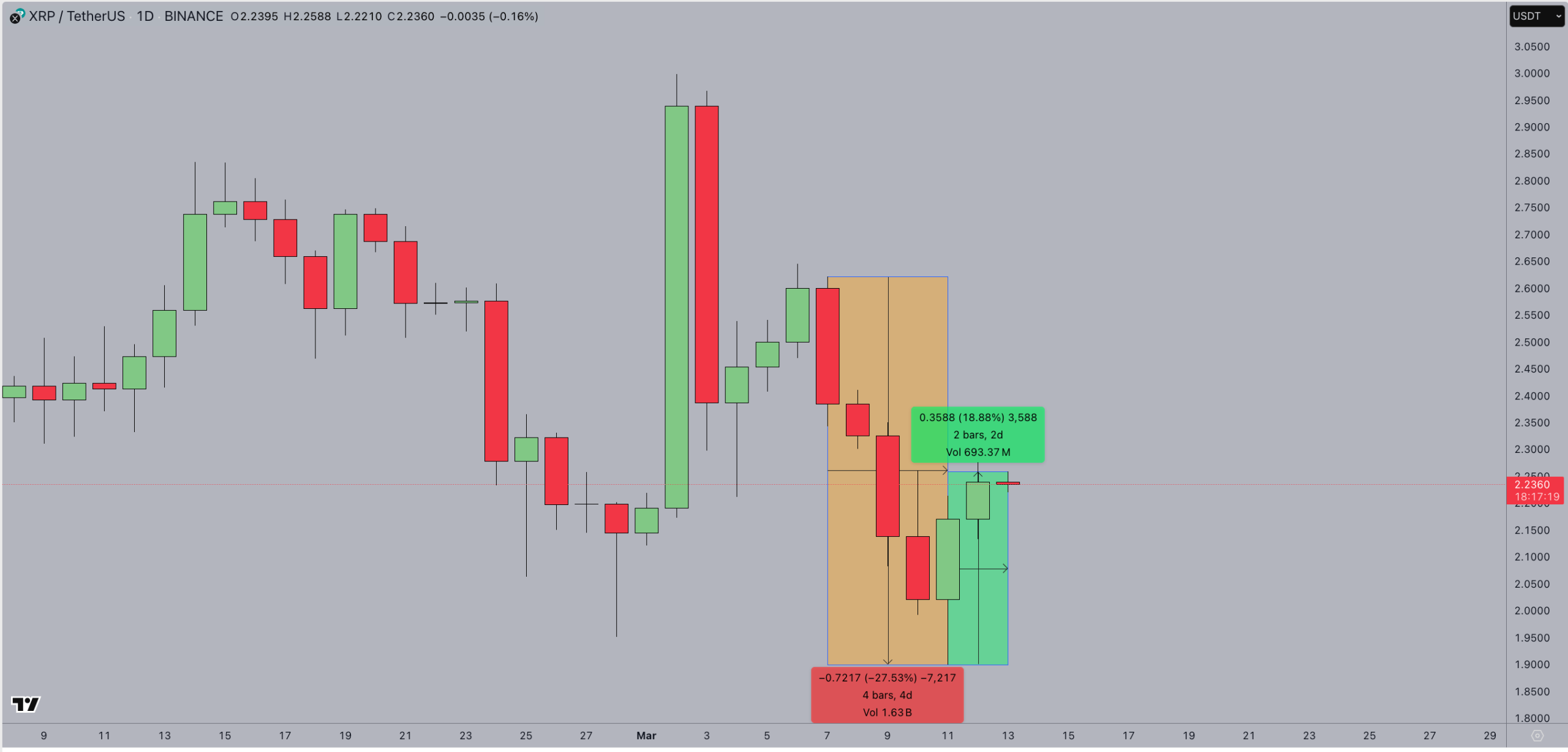

AltCurrencys: Solana (SOL) surged 8% to $134, benefiting from ETF anticipation and Decentralized finance growth. Other altCurrencys, like XRP, saw gains up to 27% amid pro-Virtual asset sentiment.

However, volatility persists, with $355 million in futures liquidations (mostly short positions) indicating rapid market shifts.

Challenges and Hazards

Despite the rebound, Hazards remain:

-

Inflation Concerns: Powell noted stubborn inflation, potentially exacerbated by Trump’s tariffs, which could delay rate cuts and pressure Virtual asset prices.

-

Economic Uncertainty: Fed projections show GDP growth slowing to 1.7% in 2025, with unemployment rising to 4.3%, signaling caution.

-

Hawkish Hazards: Fed member Raphael Bostic’s June 2025 comments suggested only one rate cut, potentially tightening liquidity and dampening Virtual asset gains.

-

Market Corrections: Some analysts warn of a “sell the news” event if anticipated cuts are priced in, as seen in 2023 when BitCurrency dipped after a pause.

Posts on X highlighted mixed sentiment, with some users bullish on BitCurrency’s recovery and others cautious due to tariff-related volatility.

Strategies for Holders

To navigate the rebound and its Hazards, consider these steps:

-

Use Dollar-Cost Averaging (DCA): Invest fixed amounts regularly (e.g., $100 weekly in BTC or ETH) to mitigate volatility. This strategy proved effective during BitCurrency’s 2022–2024 recovery from $15,500 to $80,000.

-

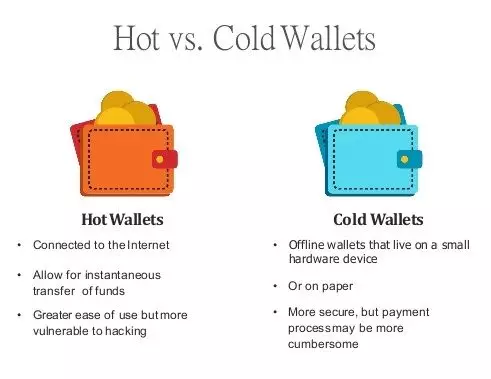

Secure Assets: Store Virtual asset in hardware wallets (e.g., Ledger Nano X) for large holdings, with seed phrases backed up offline. Use 2FA for Platform accounts.

-

Diversify: Allocate across BitCurrency, ETH, and promising altCurrencys (e.g., Solana) to balance Hazard and reward.

-

Monitor Fed Signals: Follow Powell’s speeches and FOMC projections for rate cut clues. Tools like CME’s FedWatch can gauge market expectations.

-

Stay Informed: Track Virtual asset news via Currencytelegraph, CurrencyGecko, or X communities, but verify claims independently to avoid scams.

-

Manage Hazard: Set stop-loss orders to limit losses during volatile periods, especially with tariff uncertainties looming.

The Virtual asset Landscape in 2025

As of August 3, 2025, the Virtual asset market is buoyed by institutional Usage (e.g., BitCurrency ETFs), Decentralized finance growth, and global liquidity trends.

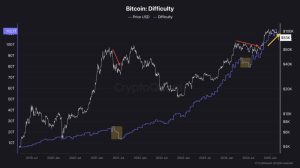

The Fed’s rate pause, combined with the 2024 BitCurrency halving, has fueled optimism, but inflation, tariffs, and economic slowdown pose Hazards.

The market’s $2.91 trillion capitalization reflects resilience, yet volatility remains a hallmark, as seen in $675 million liquidations post-December 2024.